Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

Coinbase's Solana Gamble: Genius or Just Another 2025 Acquisition?

Coinbase is scooping up Vector.fun, the Solana-based trading platform hatched by Tensor Labs. The deal, slated to close by year's end, marks Coinbase's ninth acquisition of 2025. Nine! Are they building an empire, or just throwing darts at a board? Vector.fun, for those who haven't been glued to the memecoin scene, launched last year as a challenger to Pump.fun, offering "SocialFi" features – basically, letting users ape into the same coins as the cool kids.

The immediate impact? Vector.fun's apps are getting the axe, which isn't exactly a shocker. More interesting is what happens to Tensor Marketplace and the TNSR token; they're being spun off into the Tensor Foundation. And here's where things get… complicated.

The TNSR Token Surge: An Anomaly or the New Normal?

The TNSR token has gone parabolic, surging over 500% in the last week. Even Tensor co-founder Ilja Moisejevs admitted they have "no idea what’s going on." (And this is the part of the report that I find genuinely puzzling.) That kind of volatility isn't sustainable. It smacks of pure speculation, divorced from any fundamental value. Are retail investors just piling in, hoping to ride the wave? Probably.

Coinbase is touting its vision of an “everything exchange,” promising faster, cheaper, and 24/7 access to onchain markets. The Vector.fun acquisition slots into that strategy, giving Coinbase a stronger foothold in the Solana ecosystem. Currently, Coinbase's DEX integration leans heavily on Base, their in-house blockchain. Expanding to Solana makes sense, diversifying their risk. But let's be real: Solana has had its share of outages and congestion issues. Can Coinbase really deliver that seamless "everything exchange" experience on a chain that sometimes grinds to a halt?

The Fine Print: Governance Changes and Token Burns

Now, let's dive into the governance changes. 100% of marketplace fees will now flow into the TNSR treasury, doubling the previous 50%. On paper, that looks great for token holders. But what’s the actual dollar amount we're talking about? What were the previous fees generated? Without those numbers, it’s impossible to assess the true impact.

Then there's the token burn: 21.6% of unvested founder and Labs tokens are going up in smoke. It's a nice gesture, sure, but does it materially change the tokenomics? Or is it just a PR move to signal commitment and reduce circulating supply? I’d need to see a detailed breakdown of the token distribution before and after the burn to make a call.

Founders Wu and Moisejevs are relocking their vested tokens for three more years, and staying on the Tensor Protocol Security Council. That’s a good sign, suggesting they're committed to the project's long-term success. But commitment doesn’t guarantee competence.

Coinbase is adamant that the Tensor Foundation will remain independent. They want to make it crystal clear that the Tensor NFT marketplace and token will stay independent and unaffiliated with Coinbase. But let's be honest: Coinbase now owns a piece of the puzzle. Can true independence really exist when there's a major player pulling some of the strings? It’s like saying your teenage son is totally independent while still living in your basement.

Just Another Brick in the Wall?

Ultimately, the Vector.fun acquisition is a calculated bet by Coinbase. It’s a play for Solana exposure, a move to expand their onchain offerings, and a way to scoop up some talent (11 Vector.fun employees are joining Coinbase, including the co-founders). But is it a game-changer? Or just another line item on Coinbase's ever-growing 2025 acquisition list? Time will tell, but I'm not holding my breath. According to Coinbase to acquire Vector.fun, the Tensor-built Solana trading platform, to advance 'everything exchange' vision - theblock.co, the acquisition is intended to advance Coinbase's "everything exchange" vision.

So, What's the Real Story?

Coinbase is diversifying, but this feels more like a land grab than a strategic masterpiece. The TNSR token's pump is unsustainable, and the long-term benefits of the Vector.fun acquisition remain to be seen.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

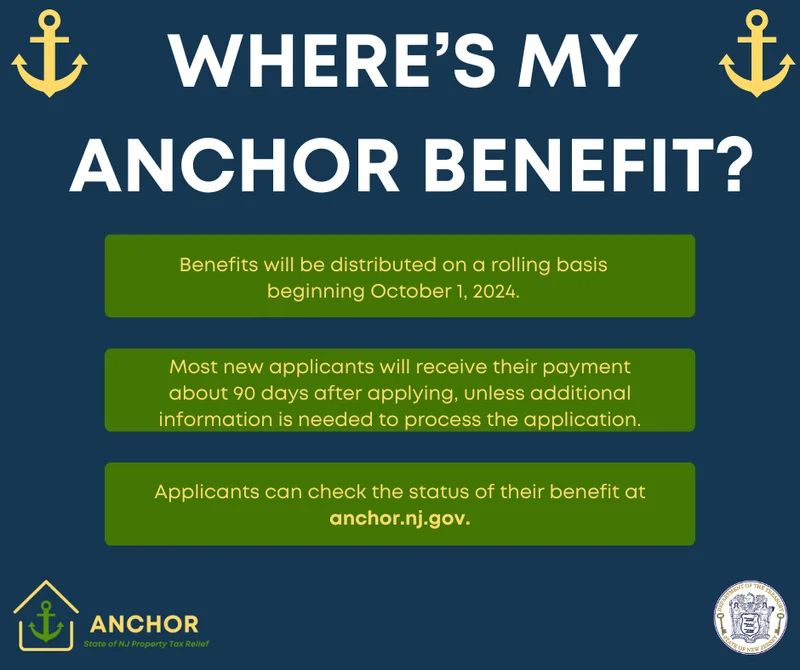

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)