Bitcoin: Price Today & Market Outlook

The Bitcoin Reality Check: When the Bull Market Narrative Hits the Bear Market Wall

The market, as it often does, has a brutal way of correcting exuberance. And right now, Bitcoin, the darling of digital finance, is getting a particularly harsh lesson. After a meteoric rise, we’ve just witnessed a gut-wrenching plummet, wiping out not just speculative gains but the entirety of its 2025 performance. It’s a stark reminder that even the most fervent belief systems in finance eventually have to face the cold, hard numbers.

Let’s be precise about this. From its record high above $126,000 in early October, bitcoin price has cratered by over 26% in a mere six weeks. On Tuesday, it was struggling just below $93,000, and for a chilling moment late Monday, it dipped below $90,000 – a level not seen in seven months. That puts its starting point for the year (around $94,000) into sharp relief, meaning every single gain, every hopeful headline, has been erased. This isn’t just a dip; this is a full-blown bear market, defined by a fall exceeding 20% from a recent peak, shedding north of $600 billion in market value. (To put that in perspective, that’s more than the GDP of entire mid-sized nations.)

This isn’t an isolated incident, either. The broader market is feeling the squeeze. US stocks closed lower on Tuesday, the Dow shedding 1.07% (a 499-point slide), the S&P 500 down 0.83%, and the tech-heavy Nasdaq Composite sliding 1.21%. The Nasdaq, in particular, has lost 6.6% since its late October record, a staggering $2.6 trillion in market value evaporated. Wall Street’s fear gauge, the VIX, jumped 10% on Tuesday, and CNN’s Fear and Greed index has plunged into "extreme fear," hitting its lowest point since early April. This isn’t a gentle correction; it’s a full-blown panic attack, fueled by investor uncertainty about the Federal Reserve's interest rate policy and a general aversion to risky assets. The market’s "orderbooks have gotten thinner" since the October 10 liquidations, making bitcoin price today even more susceptible to volatile swings.

The Human Cost: When Digital Dreams Turn to Dust

While the macro numbers paint a picture of market stress, the individual stories of loss hit differently. Take Kent Halliburton, CEO of Sazmining, a company that runs bitcoin mining hardware for clients across several countries. In August 2025, Halliburton lost over $200,000 worth of Bitcoin to a sophisticated scam. This wasn't some rookie mistake; it involved impersonated investors, a proposed $4 million deal for mining rigs, and a manipulated Atomic Wallet transaction in Amsterdam, a scenario further detailed in Inside a Wild Bitcoin Heist: Five-Star Hotels, Cash-Stuffed Envelopes, and Vanishing Funds - WIRED. The scammers weren’t amateurs; security researchers suspect a targeted, surveillance-style attack, with in-person meetings used to build rapport before the digital heist.

The stolen funds, as is typical in these operations, vanished into the digital ether with astonishing speed. They were divided, shuffled through various addresses, blended with proceeds from other scams, converted to stablecoin, and then moved across blockchains – to Tron, for example – all designed to obscure their origin. Law enforcement agencies, from the Netherlands to the UK’s Action Fraud and the US Secret Service Cyber Fraud Task Force, were notified. Their response? Acknowledged reports, but no immediate action. The sheer scale of crypto-related scam activity is "unprecedented," making individual theft investigations a near impossibility. The best chance of recovery, they say, is the bust of an entire scam ring. This begs a crucial question about the very nature of this "financial freedom": if the system is so opaque that a quarter-million-dollar theft can effectively disappear without a trace, how truly secure are individual holdings?

Despite the substantial hit – equating to about six weeks of revenue for Sazmining – the company remained solvent by delaying vendor payments and extending an outstanding loan. A testament to their resilience, perhaps, but also a stark indicator of the fragility lurking beneath the surface of the crypto economy.

The contrast here is striking. On one side, you have the cold, hard data of massive market value destruction and the chilling reality of unrecoverable theft. On the other, the unwavering optimism of figures like NBA free agent Tristan Thompson, a vocal bitcoin advocate for the past two years. He calls Bitcoin "a statement" and a "form of financial freedom," empowering individuals. He regrets not investing $10,000 in bitcoin usd in 2015, believing it could have made him a billionaire. Thompson predicts bitcoin today will reach $1 million, comparing it to early investments in Apple or Amazon. He’s building on the blockchain with a fantasy basketball project called basketball.fun, and even likens different cryptocurrencies to NBA legends: Bitcoin as Michael Jordan, ethereum as LeBron James, Solana as Stephen Curry, xrp as Kevin Durant. I've looked at hundreds of these market cycles, and this particular disconnect between cheerleading and the immediate data is, to put it mildly, disorienting.

While Thompson's enthusiasm for educating young athletes and minorities about digital assets is laudable, my analysis suggests that a healthy dose of skepticism is required. The narrative of inevitable exponential growth, while compelling, often overshadows the inherent risks and the current market realities. Bitcoin’s price surged approximately 83% from around $69,000 (pre-Trump reelection in November) to its record high above $126,000 in early October. That's a massive run, but it’s also the kind of parabolic move that often precedes a sharp correction. And that’s exactly what we’re seeing. Compare that to the S&P 500, up a more modest (and stable) 12.5% this year, or gold price, which has climbed a healthy 54%. Bitcoin’s current trajectory looks less like a steady climb and more like a bungee jump without a clear bottom. The idea that this "sideways churn" is an opportunity to build positions ignores the very real possibility of further downside, especially when global macro conditions are tightening. What happens to the narrative of "financial freedom" when the very assets meant to provide it are draining accounts, either through market forces or outright theft?

The Reckoning for the Digital Frontier

The current market conditions, combined with the grim reality of unrecoverable scams, reveal a critical vulnerability in the digital asset space. The allure of quick riches and decentralized empowerment often glosses over the fundamental lack of recourse when things go wrong. It’s like being promised a ride on a rocket ship, only to find out the parachutes are optional and emergency services are perpetually on hold. The market, as it stands, isn't just correcting; it’s demanding a fundamental re-evaluation of the core tenets of crypto investing. The belief in bitcoin stock and its brethren as an unassailable path to wealth needs to contend with the undeniable fact that its volatility can erase a year's gains in weeks, and its ecosystem can swallow fortunes whole. This isn't just about price; it's about trust, and right now, the data suggests that trust is eroding.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

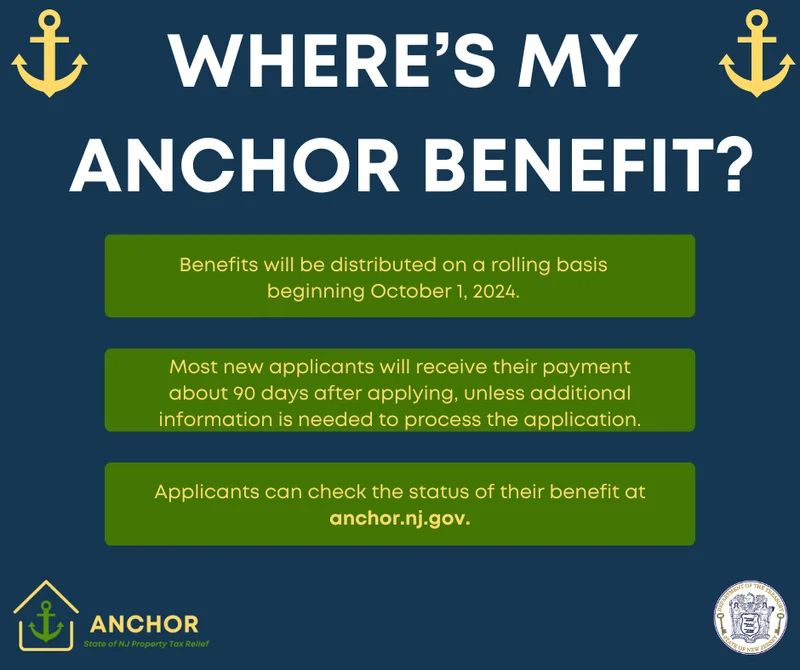

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)