MSTR Stock: What's the Price Doing vs. Bitcoin's Wild Ride?

Alright, let's get one thing straight: Michael Saylor and his MSTR are playing a dangerous game. A very dangerous game. This whole thing hinges on Bitcoin, and let's be real, Bitcoin's about as stable as a toddler on a sugar rush.

The Illusion of Value

So, MSTR is down, huh? The article says it might not be as cheap as we think. Well, duh. It's never "cheap" when you're talking about something this volatile. People are throwing around terms like "investment proxy for the cryptocurrency market." Investment proxy? Give me a break. It's a leveraged bet, plain and simple. And when that leverage unwinds...

Look, Saylor's built this whole empire on the back of BTC. He's convinced everyone that MSTR is the next big thing, a way to get exposure to Bitcoin without actually, you know, owning Bitcoin. Which is precisely the problem. It's layers upon layers of abstraction, and each layer adds more risk. It's like a matryoshka doll of financial doom.

The article mentions options trading activity. High volume on the $260 strike call option expiring November 14, 2025. Okay, so people are betting it'll go up. Big deal. People also bet on lottery tickets. Doesn't make it a sound financial strategy. Noteworthy Wednesday Option Activity: MSTR, GS, JEF

And then there's this talk about "unusual options activity data providing a valuable window into major market moves." Seriously? It's gambling, dressed up in fancy financial jargon. They're trying to sell us snake oil, and we're supposed to just swallow it whole.

The Algorithmic Mirage

This other article dives into some "alternative approach to trading Strategy (MSTR) stock options." They're throwing around terms like "stochastic processes and probability theory." Oh, and the Greeks. Delta, gamma, vega...it's enough to make your head spin.

They even drag Russian mathematicians into this mess! Kolmogorov and Markov, apparently, have the secret to options trading. Right. I'm sure those guys, wherever they are, are thrilled to be associated with this circus.

But here's the kicker: they admit that most traders don't have a model to determine where MSTR is going. So, they use implied volatility as a "secondary proxy for insight." A proxy for insight? That's like using a broken thermometer to predict the weather.

This whole "alternative approach" boils down to identifying where prices are "most likely to cluster." It's like reading tea leaves and calling it quantitative analysis.

And they have the audacity to say this approach "transforms the process from abstract math into practical probability mapping." No, it transforms it from gambling into slightly more informed gambling.

Wait, it gets better. They mention a "4-6-D formation." Four up weeks, six down weeks. And apparently, this means investors tend to buy MSTR on dips. Okay, maybe. But what happens when the dips keep dipping? What happens when Bitcoin crashes and burns, taking MSTR down with it?

They're pushing some "250/265 bull call spread expiring December 19." Maximum profit of $825, a payout of over 122%. Breakeven price of $256.75. Sounds great on paper. But what about reality? What about black swan events? What about...

Wall Street has a "Strong Buy" consensus rating on MSTR, with an average stock price target of $524.08. A 119% upside potential. Seriously? Are these analysts living in the same reality as the rest of us? Or are they just trying to pump up the stock for their own benefit? That's offcourse, a rhetorical question...

Then again, maybe I'm the crazy one here. Maybe Saylor's a genius. Maybe Bitcoin really is the future. Maybe MSTR will go to the moon.

Nah. It's a house of cards. And it's only a matter of time before it all comes crashing down.

This Ain't Gonna End Well

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

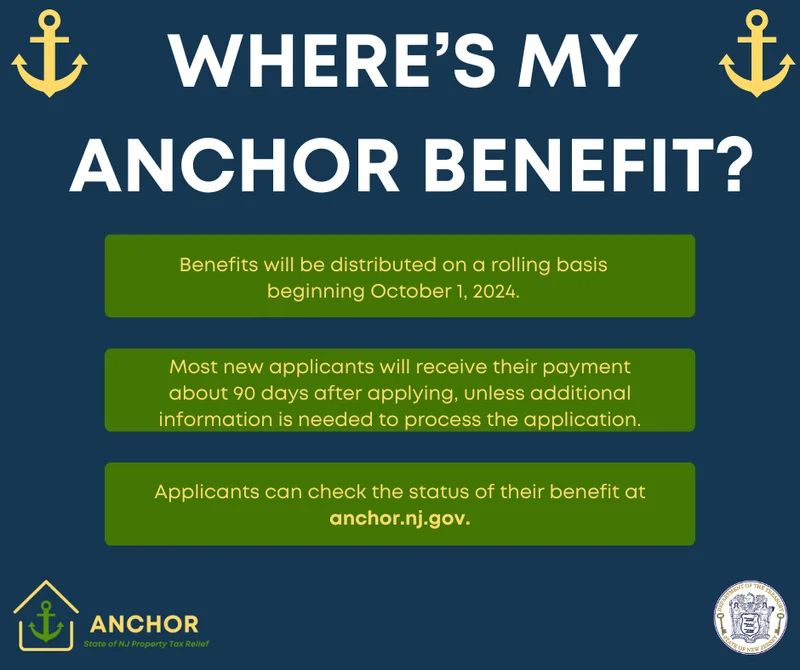

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)