mstr stock: Down 40% – Time to Panic?

Strategy, formerly MicroStrategy, is down 40% in the last six months. That’s the headline, and it’s not pretty. The company hitched its wagon—or maybe more accurately, its entire corporate existence—to Bitcoin, and now that BTC's price is swinging, MSTR is feeling the whiplash. The question is, is this a buying opportunity, a chance to cut losses, or a signal to run for the hills?

The Bitcoin Premium Problem

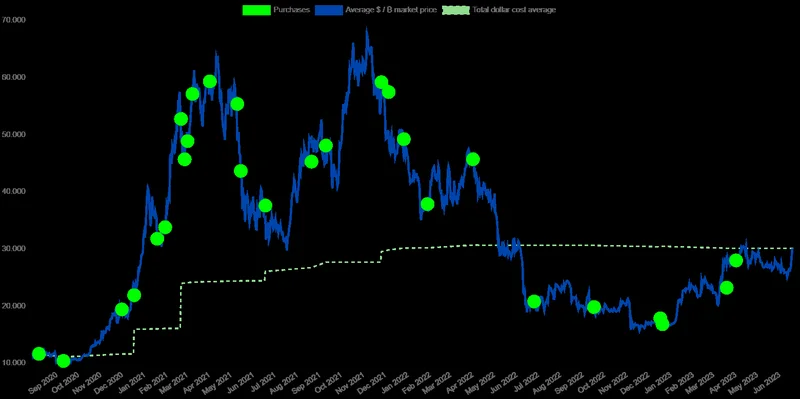

Michael Saylor's strategy of perpetually buying Bitcoin looked genius during the crypto boom. Now? Investors are rightfully questioning whether it's sustainable. Strategy’s preferred stock sale is raising eyebrows (and diluting shares), but the real kicker is the shrinking premium investors are willing to pay for MSTR shares over its Bitcoin holdings. It's like buying a car that's depreciating faster than you can drive it.

The market multiple to net asset value has shrunk from 2.7x last year to just 1.06x now, nearing a 20-month low. That’s a collapse. This makes issuing new common shares dilutive, forcing them to look at other options. They're trying to revive demand by raising the dividend on preferred shares to 10.5% in November. It's a high yield, but is it enough to offset the risk? And who exactly is buying these preferred shares at this point?

They’re also exploring international markets and even considering ETFs backed by their preferred shares. A Euro-denominated preferred share offering is expected to bring in $715 million. That’s a lot of money, but it’s also a sign they’re scrambling for capital.

Earnings vs. Reality

In Q3 2025, Strategy reported a net income of $2.8 billion thanks to unrealized gains on their $70 billion crypto stockpile. That sounds impressive until you remember it's unrealized. It's like counting your chickens before they hatch, then realizing half the eggs are duds. A few days ago, they added another 487 Bitcoin using $50 million from preferred stock sales. That's a far cry from the billion-dollar buying sprees that used to move markets. What changed?

Here's the part I find genuinely puzzling: Strategy claims they won't issue common shares below 2.5 times its net asset value, except to cover interest and dividend payments, which total $689 million annually. But with their premium hovering just above 1.0 times, that threshold is restrictive, to say the least. It's like setting a price floor so high that nobody can actually buy anything. How do they expect to navigate this?

The problem, of course, is that MSTR is now almost entirely correlated with BTC. As one source notes, Strategy's Bitcoin reserve is now up to 641,692 BTC. Back in July, when Strategy hit its year-to-date high, Bitcoin was trading around $117,489.60. Now it's closer to $105,691.30. That's only a 10% decrease for Bitcoin, but MSTR stock is down over 47% from its high. That's a discrepancy that should make any investor nervous. As reported by Barchart, the stock is Down 40% in the Past 6 Months.

Strategy's primary means of generating income is now through its Bitcoin reserve strategy, which requires funding BTC purchases via capital raises (equity and debt issuances). That equity raise is achieved by new share issuance—both common and preferred stock—which in turn has increased concerns about share dilution. It's a vicious cycle.

A House of Cards Built on Bitcoin?

Analysts, bless their optimistic hearts, still have an average price target of $523 for MSTR, implying a potential upside of over 120% from current levels. Twelve out of fifteen analysts recommend "Strong Buy." One recommends "Moderate Buy," one recommends "Hold," and one recommends "Strong Sell." Are these analysts looking at the same data I am?

Here's my thought leap: How are these analysts deriving their valuations? Are they factoring in the potential for further Bitcoin volatility? Are they accurately assessing the risk of continued share dilution? Or are they simply extrapolating past performance and hoping for the best? I suspect it's the latter.

Grand View Research projects Bitcoin will grow at a CAGR of 26.2% through 2030. Even at that rate, it would take over 15 years for Bitcoin to reach $5 million per coin—the level Strategy seems to be banking on. Meanwhile, their debt is skyrocketing. Total liabilities jumped from $2.598 billion in 2023 to $7.614 billion last year—a 193% increase. This isn't a company betting on the future; it's a company mortgaging it.

Institutional ownership is below 60%, with outflows surpassing inflows by billions over the past year. The "smart money," as they say, seems to be heading for the exits.

Is This the End of the Line?

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

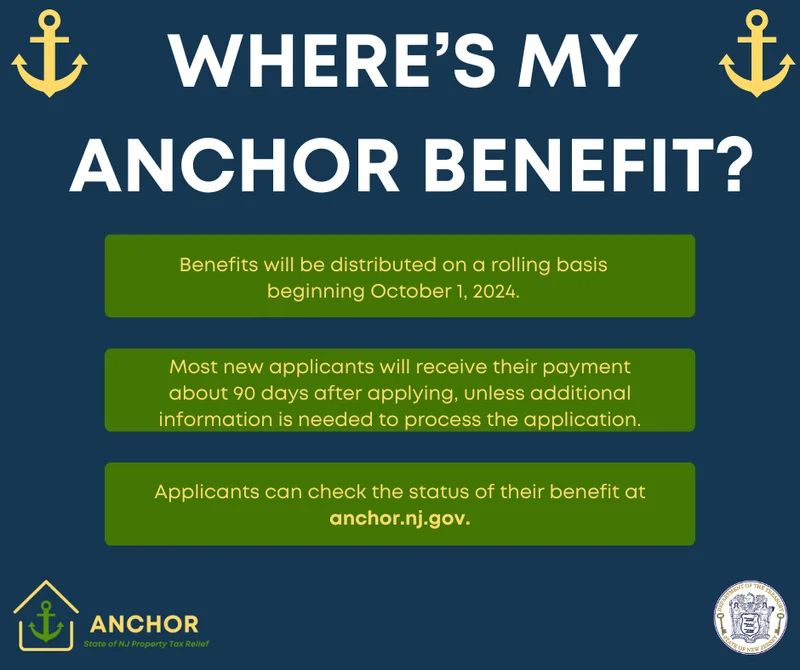

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)