Netflix Stock Price: Buy, Sell, or Hold?

Generated Title: Netflix's Stock Split: A Numbers Guy's Take

The Split: Slicing the Pie, Not Baking a New One

Netflix is doing a 10-for-1 stock split. Big deal. Honestly, these things are mostly cosmetic – a bit of financial engineering designed to make the stock feel cheaper. The share price, hovering around $1,100, will drop to something like $110. The number of shares outstanding multiplies. Market cap? Stays the same. It's like exchanging a hundred dollar bill for ten tens. You still have the same amount of money.

Some argue it makes the stock more accessible to retail investors. Maybe. But any brokerage worth its salt offers fractional shares these days. So, the "accessibility" argument feels a little weak. Options strategies? Okay, maybe there's a slight advantage there, but let's be real: most retail investors aren't playing options on Netflix.

The real question is: Does the underlying business justify the hype?

Growth: A Deep Dive into the Digits

Netflix's Q3 numbers look decent on the surface. Revenue jumped 17.2% year-over-year to $11.5 billion. Not bad. They're touting success with original programming and even sports events, like that Canelo vs. Crawford fight. (I didn't watch it. Probably should have, for research purposes).

But let's dig a little deeper. Net income only grew 8% year-over-year, landing at $2.5 billion. That's a pretty significant discrepancy between revenue and profit growth. Why? Is it content costs? Marketing spend? They don't break it down enough to be sure.

They’re pushing this narrative of global expansion, and it's true that they're in over 190 countries. The India example is interesting. Only 10 million users out of a population of 1.45 billion. That's less than 1%. Huge potential, right? Well, maybe. But India's a notoriously price-sensitive market. Can they actually extract meaningful revenue there? Or will they just end up with a bunch of low-paying subscribers who barely contribute to the bottom line?

And this is the part of the report that I find genuinely puzzling. The ad-supported tier. Management keeps saying it's a "success" and that ad revenue will "more than double" this year. Okay, great. But they don't disclose the actual numbers. Why not? If it's such a roaring success, why hide the data? It makes you wonder if the starting point was so low that even doubling it doesn't move the needle much. That’s a red flag, in my book.

Their regional performance is a mixed bag. The U.S. and Canada, their biggest market, grew 9%. Not exactly setting the world on fire. Latin America and Asia-Pacific are growing faster—27% and 26%, respectively. But those markets are smaller, so the overall impact is less significant. Plus, those growth rates are on a "constant currency basis." Which means they're stripping out the effects of currency fluctuations. That's fine, but it also paints a slightly rosier picture than reality.

Here's my methodological critique: all of these growth rates are backward-looking. They tell us what happened, not what's going to happen. The streaming market is getting more crowded every day. Disney, Amazon, Apple – they're all throwing money at content. Can Netflix really maintain these growth rates in the face of that competition? I'm skeptical.

Valuation: Are You Getting a Good Deal?

Netflix's forward price-to-earnings (P/E) multiple is around 37. The S&P 500 average is 22. Nvidia, despite its insane growth, trades at a forward P/E of about 30. (The numbers I'm seeing say 34 times next year's expected earnings, to be more exact, but even that is rich.)

Netflix bulls will argue that the premium is justified by the growth potential. Maybe. But 37 is a steep price to pay for a company with slowing profit growth. It leaves very little room for error. If they miss expectations, the stock could get hammered.

They point to the final season of "Stranger Things" as a potential catalyst. Sure, that might give them a short-term boost. But those kinds of tentpole events are fleeting. They need to consistently churn out hit content to keep subscribers engaged. And that's an expensive proposition.

Netflix: Overhyped or Undervalued?

The stock split is a sideshow. Focus on the fundamentals. The growth story is still intact, but the valuation is stretched. Proceed with caution. Some analysts believe Netflix is still a buy, even after the split. 4 Reasons Netflix Stock Is a Buy Today

Smoke and Mirrors

I'm not buying the hype. Netflix is a good company, but the stock is priced for perfection. And in this market, perfection is a very high bar to clear.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

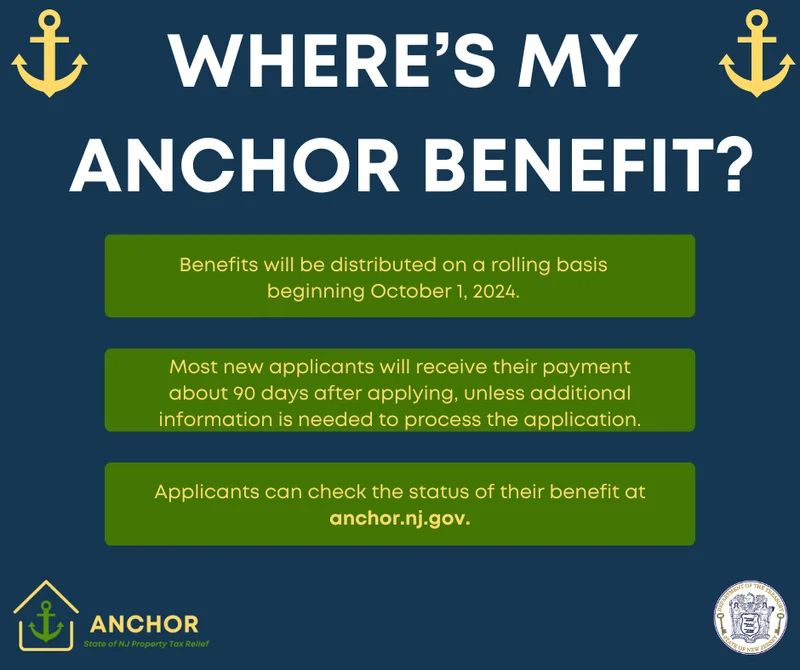

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)