Social Security Increase 2026: What the Chart Reveals

Generated Title: Social Security's 2.8% COLA: A Sugar Pill, Not a Cure

Social Security recipients are about to get a little extra in their checks, with a 2.8% cost-of-living adjustment (COLA) slated for 2026. On the surface, that sounds like good news, right? More money is always welcome, especially for those on fixed incomes. But let's dig into the numbers, shall we? Because the devil, as always, is in the details.

The COLA Calculation: Averages and Absurdities

The Social Security Administration (SSA) bases its COLA on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). They compare the average CPI-W for the third quarter of the current year to the same period last year. The percentage change becomes the COLA. This year, that difference clocked in at 2.8%. In theory, that's supposed to keep pace with inflation.

Here's where things get sticky. The CPI-W tracks spending patterns of working-age folks. But retirees? They have different spending habits. They spend more on healthcare, housing, and insurance – sectors that often see price increases above the general inflation rate. So, a 2.8% COLA based on CPI-W might not actually cover the real cost increases faced by seniors. It's like using a weather forecast for Miami to plan a trip to Anchorage.

Shannon Benton, executive director for The Senior Citizens League, gets it. She said, "The 2026 COLA is going to hurt for seniors." She wants Congress to tweak the COLA calculation to better reflect seniors' actual expenses. And she has a point.

The average Social Security retirement benefit will increase by roughly $56 per month. But then comes Medicare Part B premiums. While the official announcement is pending, projections point to an 11.6% increase, potentially adding $21.50 to the existing $185 monthly premium. (That's $206.50 total.) So, about 38% of that COLA bump is already earmarked for healthcare before it even hits their bank accounts.

I've looked at hundreds of these benefit statements, and the disconnect between the COLA and actual purchasing power is becoming a chasm. The 2026 COLA Is Set -- Here's the Good and Bad News for Social Security Recipients

Earnings Limits and Taxable Maximums: Tweaks at the Margins

Beyond the COLA, there are a couple of other changes on the horizon.

For those who retire early (before their full retirement age) but continue to work, the earnings limits are going up. In 2026, the SSA will deduct $1 in benefits for every $2 earned above $24,800. That's up from $23,400 in 2025 – a bump of $1,400. If you're still working while drawing Social Security, that extra bit of wiggle room is nice, but it's hardly a game-changer. It's more like rearranging deck chairs on the Titanic.

Then there's the increased maximum taxable earnings. High-income earners will see the amount of their income subject to Social Security taxes rise to $184,500, up from $176,100. All employees must pay 7.65% of their salaries to help fund both Social Security and Medicare. Employers pay the same rate for each employee. Self-employed individuals pay both the employee and employer FICA taxes, for a total of 15.3%.

This means higher taxes for some, but it also means more revenue flowing into the Social Security system. But here's the rub: this change, while significant, doesn't address the long-term solvency issues facing Social Security. It's a temporary patch, not a permanent fix.

The Illusion of Progress

The 2.8% COLA is being presented as a victory, but it's more like a sugar pill. It provides a temporary sense of relief without addressing the underlying disease. The fundamental problem remains: the COLA calculation doesn't accurately reflect the spending patterns of retirees, and healthcare costs are eating away at any gains.

Social Security needs real, structural reforms – not just tweaks around the edges. We need a COLA calculation that's tailored to seniors' needs, and we need to address the rising cost of healthcare. Until then, these annual adjustments are just window dressing.

The COLA Mirage: A Disconnect From Reality

The 2.8% COLA is a mirage. It looks like relief, but it doesn't quench the thirst.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

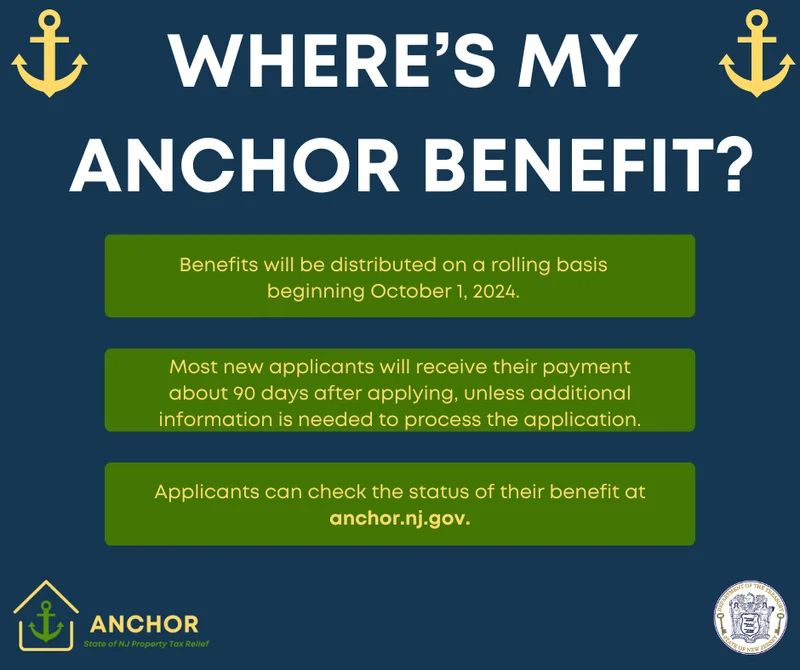

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)