GOOGL Stock: Berkshire Hathaway's Bet and What It Really Means

Alright, let's get one thing straight: Warren Buffett buying into Alphabet now isn't some genius move. It's him finally admitting he was asleep at the wheel for the last two decades.

Late to the Party, Again

So, Berkshire Hathaway scooped up 17.8 million shares of Alphabet in Q3 2025. Big deal. The stock is up 46% this year. Talk about buying high. It's like showing up to a concert halfway through the encore and acting like you discovered the band.

And let's not forget Charlie Munger – bless his soul – admitting he regretted not seeing Google's potential earlier. Regret? That's putting it mildly. It's a monumental screw-up that cost them billions. Billions they could have used to, I don't know, actually innovate instead of hoarding cash like a dragon.

Speaking of which, Berkshire's been sitting on a mountain of cash, right? A "cautious stance," they call it. I call it paralysis. They're so afraid of making a mistake that they miss out on every opportunity. It's like being so worried about getting your shoes dirty that you never leave the house.

AI Hype or Real Potential?

Now, everyone's buzzing about AI. Alphabet, Amazon, Meta, Microsoft – they're all throwing money at it like it's going out of style. Morgan Stanley estimates $3 trillion on data centers alone. Three. Trillion. Dollars.

Is it a bubble? Maybe. Are they just chasing the next shiny object? Probably. But here's the thing: Google is still Google. They still dominate search, advertising, and cloud computing. And even if AI turns out to be a bust, they'll probably find some other way to monetize our data. Because that's what they do best.

But the real question is: what took Buffett so long? Was he waiting for someone to explain AI to him with puppets? Did he finally realize that the internet isn't just a fad? I mean, come on!

Oh, and the stock jumped 4% after the news broke. Color me shocked. People treat Buffett's moves like the word of God. It's ridiculous.

Honestly, it feels like people are still living in 2008.

The End of an Era

And here's another thing: Buffett is stepping down soon. "Going quiet," he says. No more annual reports, no more endless rambling at the annual meeting. It's the end of an era, sure, but maybe it's also time for some fresh blood. Maybe someone who actually understands the 21st century can take the reins.

Though, let's be real, even with Buffett out of the picture, Berkshire is still going to be Berkshire. Cautious, slow-moving, and always a few steps behind the curve.

And, offcourse, don't forget Alphabet's facing antitrust investigations. Because being a monopoly isn't a problem these days, apparently.

So, What's the Real Story?

Buffett's not a visionary. He's a value investor. And he probably just saw that Alphabet was "undervalued" or some other Wall Street BS. Let's not pretend this is some grand strategic masterstroke. It's a calculated, and frankly overdue, move. And honestly, I'm not holding my breath waiting for them to suddenly become cutting-edge. That ain't gonna happen.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

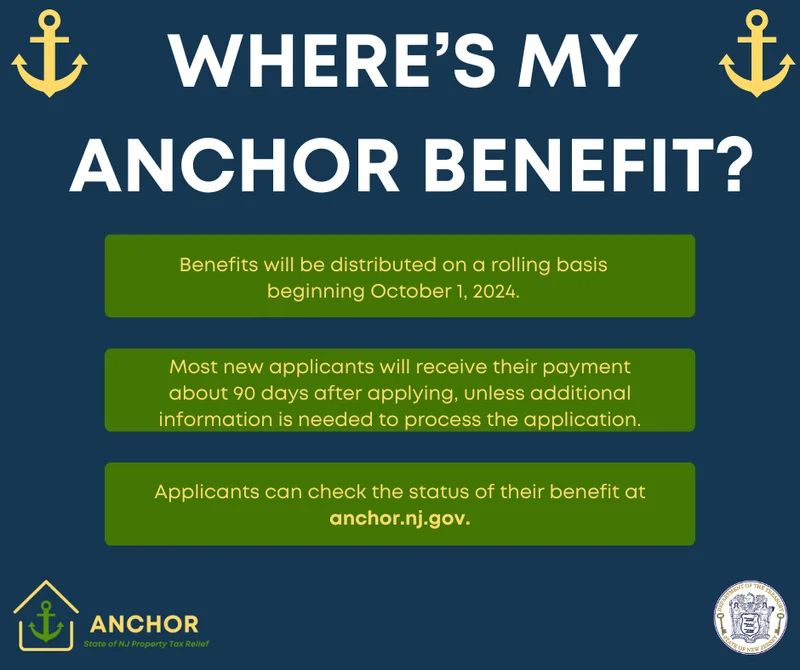

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)