Cross-Border Payments: What's the Deal?

Alright, let's get this straight. Every freakin' week, some new "innovation" promises to revolutionize cross-border payments. Yawn. Wake me up when it actually works.

Wealthsimple's Wise Move: Or Just Wise Marketing?

So, Wealthsimple's now buddy-buddy with Wise, formerly TransferWise, to make international transfers "seamless." They're touting faster, cheaper payments to 30 countries. Okay, great. But let's be real, "seamless" is the most overused word in fintech. It's like saying a new burger is "delicious." No freakin' duh, that's the point!

Zaidi from Wealthsimple claims "no hidden markups." Right. Show me the fine print. I've been burned before. These "disruptors" always find a way to nickel and dime you. And the transfers "can't be cancelled once they are sent"? What is this, the Wild West?

They're bragging about serving 3 million customers and aiming for $1 trillion in assets by 2034. Whoop-dee-doo. That just means they're getting bigger, not necessarily better.

And speaking of bigger, what's with all these partnerships? Wealthsimple with Wise, Alibaba talking stablecoins with JPMorgan... It's like everyone's afraid to go it alone. Where's the actual innovation? Are they so scared of risk that they have to huddle together like penguins in a blizzard?

Stablecoins and Casino Crackdowns: A Tangled Web

Oh, and don't even get me started on stablecoins. Wealthsimple's "closely following" the government's work on stablecoin legislation. Translation: they're waiting to see if they can make a quick buck off the crypto craze without getting slapped with a lawsuit.

And then there's the elephant in the room: money laundering. The U.S. and Mexico are cracking down on casinos funneling cartel cash overseas. It's all connected, ain't it? Cross-border payments, stablecoins, and shady dealings... it's a perfect storm of financial BS. Cross-Border Casino Crackdown Targets Cartel Cash

Makes you wonder, how much of this "seamless" cross-border movement is actually facilitating something illegal?

I was promised a seamless experience when I ordered takeout last night. It arrived an hour late and cold. So, forgive me if I'm not exactly jumping for joy at Wealthsimple's promises.

The SMB Struggle is Real

And let's spare a thought for the small businesses caught in this crossfire. Shifting tariffs, global uncertainty, growing fraud... it's a minefield out there. Are banks really doing enough to support them? Or are they too busy chasing the next shiny fintech object? Uncertain Times: Small Business Banking and Cross-Border Payments Amid Global Chaos

Banks need to step up and protect their SMB customers from all this financial chaos. But, offcourse, that would require them to, you know, actually care.

It's easy to get cynical, I know. Maybe I'm just jaded. Maybe I'm expecting too much. But I've seen this movie before. The "future of finance" always seems to benefit the big players, not the little guy.

So, What's the Scam This Time?

Look, I'm not saying Wealthsimple's evil, or anything. But let's not pretend this is some revolutionary act of altruism. It's business. And in business, the bottom line always wins. Whether that benefits you is another story.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Business of Plasma Donation: How the Process Works and Who the Key Players Are

Theterm"plasma"suffersfromas...

-

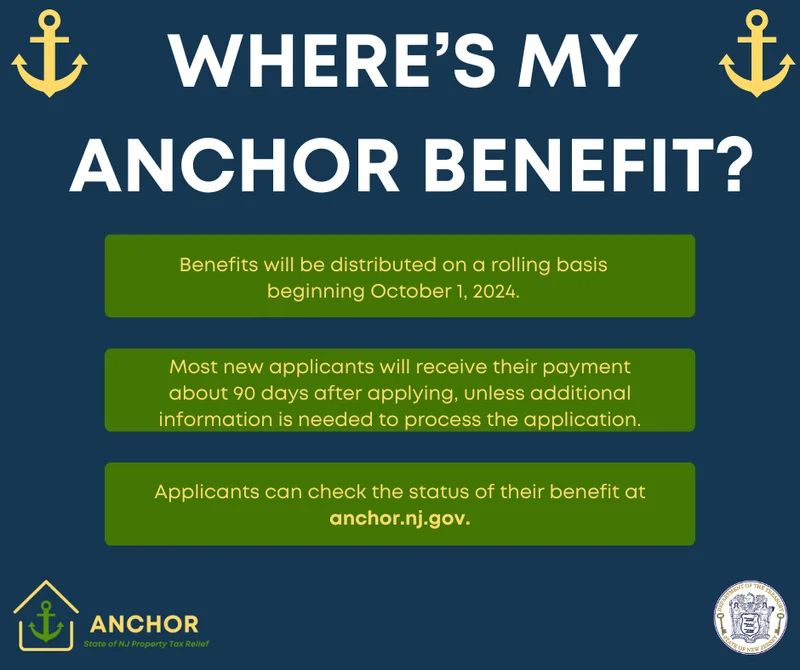

NJ's ANCHOR Program: A Blueprint for Tax Relief, Your 2024 Payment, and What Comes Next

NewJersey'sANCHORProgramIsn't...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

- Search

- Recently Published

-

- Ethereum's Fusaka Upgrade: The 'Future' They're Selling vs. The Reality We'll Get

- TransUnion: Reimagining Credit's Future and Your Financial Journey

- Solana Acquires Vector.fun: Coinbase's "Everything Exchange" Strategy

- Scott Kirby at American Airlines: Decoding the Future of United Through His Past

- Nvidia Stock: Price Movements and Earnings Outlook

- Bitcoin: Price Today & Market Outlook

- Maxi Doge: Presale Buzz and Crypto News – What We Know

- Fear and Greed Index Plunges: Crypto Market Reactions and What We Know

- Pizza's Next Chapter: Innovation and Our Changing Tastes

- Firo Hard Fork: Likely Price Impact and What We Know

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (5)

- NFT (5)

- Solana (6)

- cryptocurrency (6)

- XRP (3)

- Airdrop (3)

- MicroStrategy (3)

- Stablecoin (3)

- Digital Assets (3)

- bitcoin (3)

- PENGU (3)

- Plasma (5)

- Zcash (7)

- Aster (5)

- investment advisor (4)

- crypto exchange binance (3)

- SX Network (3)